Top Guidelines Of Financial Education

Wiki Article

The Single Strategy To Use For Financial Education

Table of ContentsGetting My Financial Education To WorkFinancial Education for DummiesIndicators on Financial Education You Need To Know3 Easy Facts About Financial Education DescribedFascination About Financial EducationThe Only Guide to Financial EducationGetting The Financial Education To Work

This is their intro to the economic realm. A lot of think that an individual's monetary trip starts when they start with their adult years, yet it begins in childhood. Kids nowadays have very easy access to practically any type of sources, whether it is cash or some asset that money can get. This did not exist in the older generation, where also when sources were available, they did not have points handed to them.Asking your parents for costly gifts like an i, Phone, Mac, Book, or Apple Watch, as well as then throwing temper tantrums over it demonstrates how you are not prepared for the globe around. Your moms and dads will certainly attempt to explain this to you, but children, especially teenagers, rarely understand this. If not taught the importance of thinking critically before spending, there will certainly come a time when the following gen will certainly deal with problems, as well as not discover how to manage finances as a grownup.

Early understanding of principles like the worth of intensifying, the difference between requirements and desires, postponed satisfaction, chance cost and most importantly duty will certainly hold the future generation in good stead. Best Nursing Paper Writing Service. Worths of possessions and cash can not be educated overnight, as a result starting young is necessary. Simply put, whether you like it or not, economic monitoring slowly comes to be an important component of life, and also the earlier one begins inculcating the behavior; the earlier they will certainly master it, and also the much better prepared they will be.

The Best Guide To Financial Education

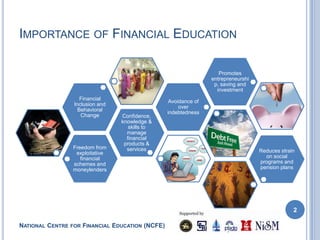

If, however, it is made necessary in colleges or instructed by moms and dads at house, the benefits would be profound: 1. Capability to make much better economic decisions 2.

6 Simple Techniques For Financial Education

Moms and dads constantly think about guaranteeing to keep enough cash for their kids, nevertheless, they stop working to understand that one even more action needs to be included their future preparation for their youngsters. They need to inculcate the basics of finance in kids before they head out into the world individually due to the fact that doing so will certainly make them more liable and also make their life far much more convenient! Sights expressed above are the writer's own.And also you continuously take notice of your general portfolio incomes, cost savings and also investments. You additionally recognize what you don't recognize, and you request for help when you require it. To be monetarily literate ways having the capacity to not let cash or the lack of it obtain in the means of your joy as you strive and also develop an American desire complete with a lengthy and also fulfilling retired life.

Personal finance professionals suggest making the effort to find out the basics, from just how to manage a checking or debit account to just how to pay your bills in a timely manner and also construct from there. Managing your money needs consistent attention to your costs and also to your accounts as well as not living past your financial ways.

Financial Education - An Overview

You will certainly webpage miss out on passion produced by a savings account. With cash in an account, you can start investing.You wikipedia reference require to see exactly just how you're spending your cash and determine where your financial openings are. Start tracking your month-to-month expenses In a note pad or a mobile application, compose in every time you invest money.

And also take a look at the groups. 4. Study your variable expenditures This is where many people have a tendency to overspend. Choose what offers you the many pleasure from these month-to-month expenditures that you feel these expenses are rewarding? And which ones can you truly do without? Be straightforward, and begin cutting. This is the start of the tough decisions.

8 Easy Facts About Financial Education Explained

Consider savings A key part of budgeting is that you should constantly pay yourself first. That is, you should take a section of every income and also placed it into savings. This one practice, if you can make it a habit, will certainly pay rewards (essentially in lots of situations) throughout your life.Currently set your budget Beginning making the needed cuts in your taken care of as well as variable expenses. The remaining money is just how much you have to live on.

Debit cards have advantages like no limit on the quantity of deals and also benefits based on regular use. You have the capacity to invest without bring cash as well as the money is quickly withdrawn from your account. Because utilizing the card is so very easy, it is important that you do not overspend and also misplace just how frequently you're investing with this account.

Financial Education for Beginners

Some hotels, cars and truck rental firms as well as various other businesses require that you utilize a bank card. Getting an account created for periodic usage can be a sensible choice. You can develop your credit report and also capitalize on the time barrier in between buying and also paying your costs. Another advantage of using credit rating is the added securities provided by the company.Relying upon a bank card can cause handling major debt. Should you choose to possess a charge card, the very best technique of action is paying in complete monthly. It is likely you will already be paying rate of interest on your purchases as well as the even more time you rollover an equilibrium from month to month, the more interest you will certainly pay.

74 trillion Financial specialist Chip Stapleton provides a sensible technique to obtain as well as remain out of debt that any individual can practice. A credit report score can be a solid indication of your monetary health.

The smart Trick of Financial Education That Nobody is Discussing

You can get a copy of your credit score wikipedia reference record free of charge when each year from each of the credit bureaus. Building a high credit history can aid you obtain authorization for low-interest loans, credit report cards, home mortgages, and also auto settlements. When you are looking to relocate right into a home or obtain a brand-new task, your credit rating might be a determining variable.Report this wiki page